All Categories

Featured

Table of Contents

It allows you to budget plan and prepare for the future. You can quickly factor your life insurance coverage right into your budget plan since the premiums never transform. You can prepare for the future equally as conveniently since you recognize exactly just how much money your loved ones will obtain in the occasion of your absence.

This is true for individuals that gave up cigarette smoking or who have a wellness problem that fixes. In these instances, you'll typically need to go with a new application process to obtain a much better rate. If you still need protection by the time your level term life plan nears the expiry date, you have a few choices.

The majority of degree term life insurance coverage policies include the alternative to renew protection on an annual basis after the initial term ends. what is direct term life insurance. The expense of your policy will be based upon your current age and it'll raise every year. This might be a good option if you just need to prolong your insurance coverage for 1 or 2 years or else, it can obtain pricey pretty promptly

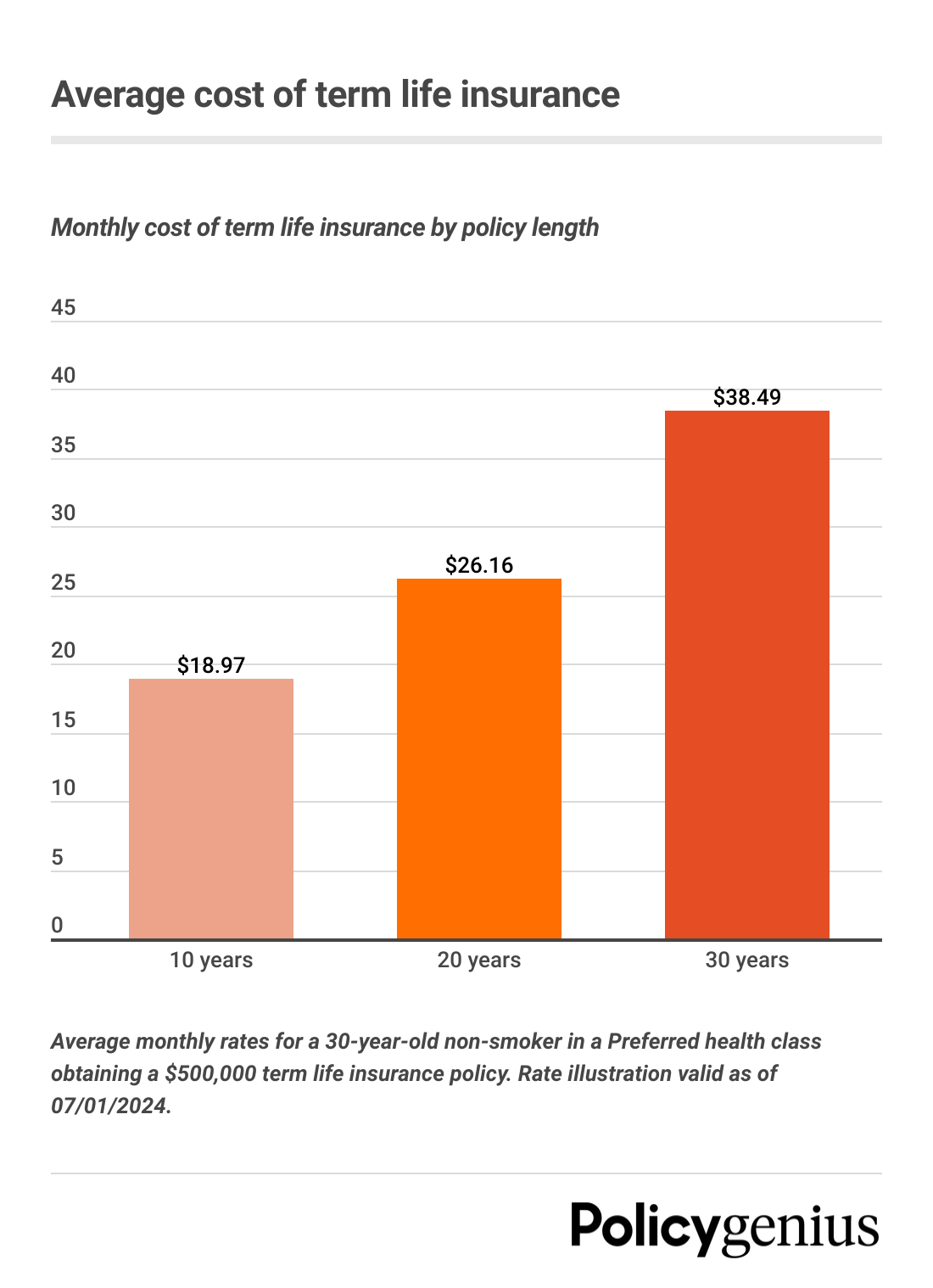

Degree term life insurance coverage is among the most inexpensive protection choices on the market due to the fact that it provides standard protection in the type of fatality benefit and only lasts for a collection time period. At the end of the term, it ends. Entire life insurance policy, on the various other hand, is dramatically more costly than level term life since it doesn't expire and features a cash worth feature.

Quality Short Term Life Insurance

Rates might vary by insurance company, term, insurance coverage quantity, health and wellness course, and state. Level term is a wonderful life insurance coverage option for most people, yet depending on your insurance coverage requirements and individual scenario, it might not be the best fit for you.

This can be an excellent option if you, for example, have simply give up smoking cigarettes and need to wait two or 3 years to use for a level term policy and be eligible for a lower price.

Secure What Is Direct Term Life Insurance

With a decreasing term life policy, your fatality advantage payment will certainly lower gradually, but your repayments will remain the very same. Lowering term life policies like home mortgage defense insurance typically pay out to your lending institution, so if you're searching for a plan that will pay to your loved ones, this is not a good fit for you.

Enhancing term life insurance policy policies can assist you hedge against inflation or strategy monetarily for future kids. On the other hand, you'll pay more ahead of time for much less protection with an increasing term life policy than with a level term life policy. If you're uncertain which type of plan is best for you, working with an independent broker can assist.

Once you've made a decision that degree term is appropriate for you, the following action is to acquire your policy. Below's how to do it. Compute just how much life insurance coverage you require Your coverage amount should attend to your family's lasting financial demands, consisting of the loss of your earnings in case of your death, in addition to debts and daily expenditures.

A level costs term life insurance policy plan allows you stick to your spending plan while you aid secure your household. Unlike some tipped price strategies that enhances each year with your age, this kind of term strategy supplies prices that stay the same through you pick, also as you obtain older or your health modifications.

Discover more about the Life insurance policy options readily available to you as an AICPA member. ___ Aon Insurance Policy Services is the trademark name for the broker agent and program administration procedures of Fondness Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Agency, Inc. (CA 0795465); in OK, AIS Fondness Insurance Coverage Providers Inc.; in CA, Aon Affinity Insurance Policy Solutions, Inc.

Reputable Level Term Life Insurance Meaning

The Plan Agent of the AICPA Insurance Depend On, Aon Insurance Coverage Services, is not associated with Prudential. Group Insurance policy protection is provided by The Prudential Insurance Coverage Firm of America, a Prudential Financial firm, Newark, NJ. 1043476-00002-00.

Latest Posts

Senior Care Usa Final Expense

Life And Burial Insurance

Final Expense Insurance Quote