All Categories

Featured

Table of Contents

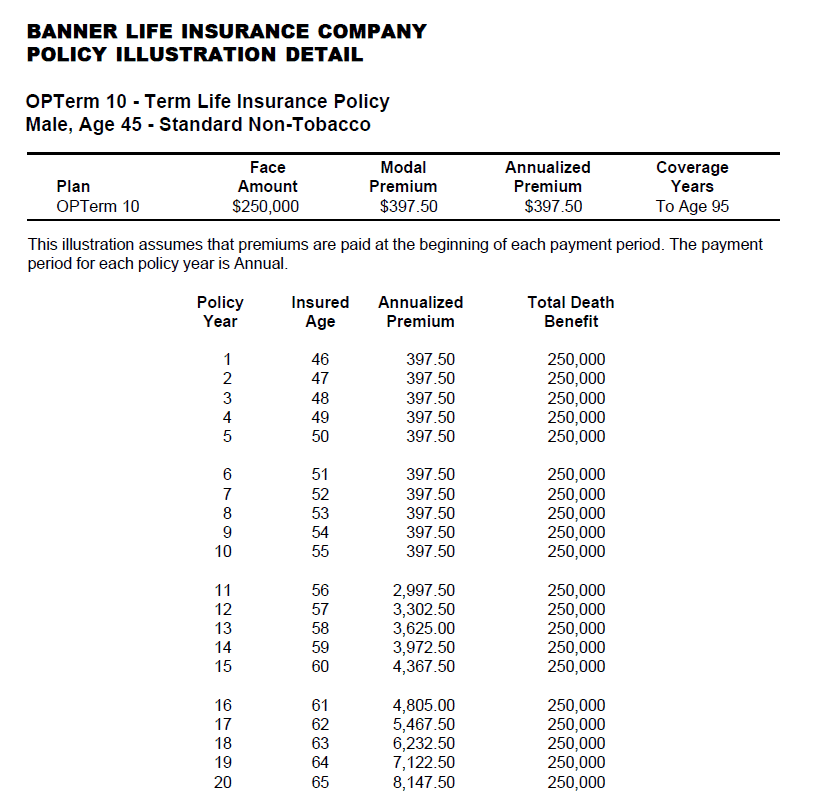

A level term life insurance policy plan can offer you comfort that the individuals who depend on you will certainly have a fatality benefit throughout the years that you are planning to support them. It's a way to assist deal with them in the future, today. A degree term life insurance (in some cases called level costs term life insurance coverage) plan gives insurance coverage for an established number of years (e.g., 10 or two decades) while maintaining the costs payments the same throughout of the plan.

With level term insurance policy, the expense of the insurance will certainly stay the very same (or potentially reduce if rewards are paid) over the regard to your policy, typically 10 or two decades. Unlike long-term life insurance, which never ends as long as you pay premiums, a degree term life insurance policy will finish eventually in the future, generally at the end of the period of your degree term.

The Basics: What is What Does Level Term Life Insurance Mean?

As a result of this, several individuals utilize permanent insurance coverage as a secure financial planning tool that can offer numerous demands. You may be able to convert some, or all, of your term insurance coverage throughout a set duration, normally the very first ten years of your policy, without needing to re-qualify for coverage even if your health has altered.

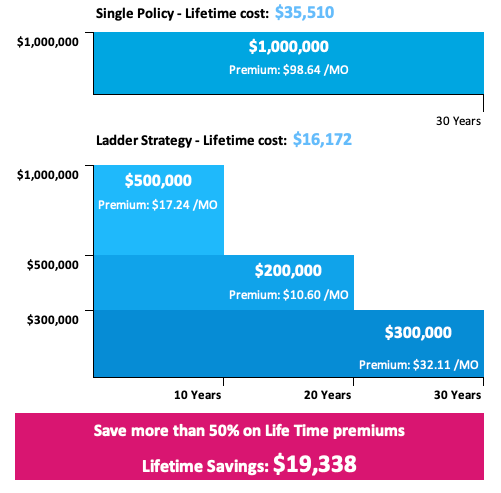

As it does, you may desire to add to your insurance policy protection in the future - 10-year level term life insurance. As this happens, you might desire to at some point reduce your fatality advantage or think about transforming your term insurance policy to a permanent policy.

So long as you pay your premiums, you can relax easy knowing that your liked ones will certainly get a death benefit if you pass away throughout the term. Several term policies allow you the capacity to convert to permanent insurance without having to take another wellness test. This can enable you to take benefit of the additional advantages of an irreversible plan.

Degree term life insurance policy is one of the most convenient paths into life insurance policy, we'll discuss the benefits and downsides so that you can choose a strategy to fit your needs. Degree term life insurance policy is one of the most typical and fundamental type of term life. When you're searching for short-term life insurance coverage plans, degree term life insurance policy is one path that you can go.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. final expense insurance for funeral costs with brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

You'll fill out an application that has basic personal details such as your name, age, etc as well as an extra comprehensive survey concerning your medical history.

The short solution is no., for example, let you have the convenience of fatality advantages and can accrue cash money value over time, indicating you'll have a lot more control over your benefits while you're to life.

What Makes Term Life Insurance Unique?

Motorcyclists are optional stipulations included to your policy that can provide you additional advantages and protections. Anything can happen over the course of your life insurance policy term, and you want to be ready for anything.

This motorcyclist gives term life insurance policy on your kids via the ages of 18-25. There are instances where these benefits are developed into your policy, but they can likewise be readily available as a separate enhancement that needs extra repayment. This rider offers an added death advantage to your beneficiary should you die as the outcome of an accident.

Latest Posts

Senior Care Usa Final Expense

Life And Burial Insurance

Final Expense Insurance Quote