All Categories

Featured

Table of Contents

Term life insurance might be better than mortgage life insurance policy as it can cover mortgages and various other costs. Contrast life insurance online in mins with Everyday Life Insurance Policy. Mortgage life insurance policy, additionally referred to as, mortgage defense insurance policy, is marketed to homeowners as a way to settle their home mortgage in case of fatality.

Although it seems great, it might be far better to get a term life policy with a huge survivor benefit that can cover your home mortgage for your beneficiary. Home mortgage life insurance policy pays the rest of your home mortgage if you pass away throughout your term. "Mortgage defense insurance is a method to discuss insurance coverage without discussing passing away," states Mark Williams, Chief Executive Officer of Brokers International.

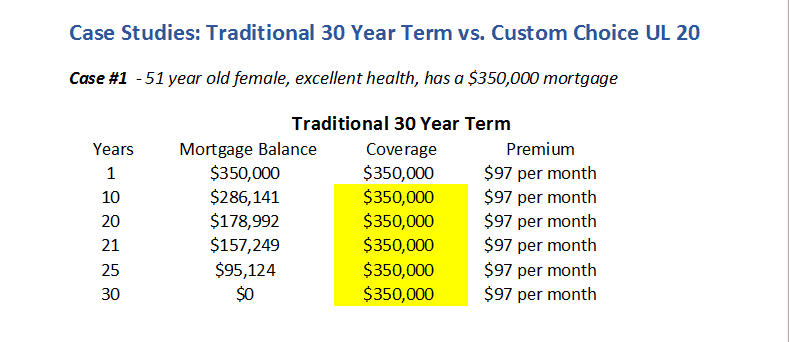

Unlike a standard term life insurance policy that has the same premium, it's prices and the fatality advantage typically reduce as your mortgage lowers. This insurance coverage is often confused with private home loan insurance, however they are extremely different principles. insurance pay off mortgage case death. If you have a mortgage and your deposit is less than the typical 20%, your lending institution will certainly require mortgage insurance to safeguard them in case you skip on your mortgage repayments

Williams claimed an individual can name a partner as the beneficiary on a home mortgage defense insurance coverage. The partner will obtain the money and can choose whether to repay the home mortgage or offer the house. If a person has home loan life insurance policy and a term life policy with the partner as the recipient on both, after that it can be a dual windfall.

Decreasing term insurance coverage is the more usual kind of home mortgage life insurance policy. With this policy, your insurance premiums and insurance coverages decrease as your mortgage amount lowers. Level term insurance coverage provides a fixed fatality advantage through the duration of your home mortgage. This kind of home loan life insurance would certainly appropriate for a policyholder with an interest-only mortgage where the borrower just pays the interest for a specific amount of time.

Home Mortgage Insurance Cost

Home loan life insurance policy also needs no medical tests or waiting durations. If you pass away with an impressive mortgage, home mortgage life insurance pays the remainder of the car loan directly to the lender. In turn, your loved ones do not need to handle the economic worry of paying off the mortgage alone and can concentrate on regreting your loss.

Your mortgage life insurance policy plan is based upon your home loan quantity, so the details will certainly differ depending on the price of your home loan. Its rates reduce as your home mortgage decreases, yet premiums are usually extra costly than a typical term life plan - decreasing life insurance to cover mortgage. When selecting your survivor benefit amount for term life insurance coverage, the guideline is to pick 10 times your yearly revenue to cover the home loan, education and learning for dependents, and various other costs if you die

Your mortgage life insurance plan terminates when your home loan is paid off. If you pay off your mortgage prior to you pass away, you'll be left without a death benefitunless you have various other life insurance.

Average Mortgage Life

The two most usual long-term life insurance policy plans are entire life and global life insurance policy. With an entire life plan, you pay a fixed costs for an ensured survivor benefit. The plan's money worth additionally grows at a set rate of interest rate. In contrast, an universal life policy enables you to adjust when and just how much you pay in premiums, consequently readjusting your protection.

Home mortgage life insurance policy may be a great choice for homeowners with health problems, as this insurance coverage gives instant protection without the need for a clinical exam. Nonetheless, standard life insurance policy might be the most effective option for many people as it can cover your home mortgage and your other monetary responsibilities. Plus, it tends to be cheaper.

You can additionally call other beneficiaries, such as your partner or kids, and they'll get the fatality benefit. With lowering term insurance policy, your insurance coverage decreases as your home mortgage reduces. With degree term insurance, your coverage quantity stays the same throughout the term. No, lending institutions do not need home mortgage life insurance policy.

Mortgage Insurance Payout

Yes. One perk of home mortgage life insurance over a typical term policy is that it usually does not need a medical examination. So, house owners with pre-existing conditions typically get approved for this protection, but it is essential to consult the plan issuer to verify any kind of exemptions or restrictions. Ronda Lee is an insurance policy specialist covering life, vehicle, house owners, and tenants insurance coverage for customers.

ExperienceAlani is a former insurance other on the Personal Money Expert team. She's evaluated life insurance and family pet insurer and has actually composed various explainers on traveling insurance, credit, debt, and home insurance. She is passionate about demystifying the intricacies of insurance and other individual money topics to make sure that visitors have the details they require to make the most effective cash choices.

When you get a home mortgage to get your home, you will typically need to get home mortgage defense insurance policy. This is a specific sort of life guarantee that is obtained for the term of the home loan. It repays the home loan if you, or someone you have the mortgage with, dies.The loan provider is lawfully required to make certain that you have home mortgage security insurance prior to offering you a home mortgage.

Home Equity Insurance Policy

If you pass away without home mortgage insurance protection, there will certainly be no insurance policy to repay the home mortgage. This means that the joint proprietor or your beneficiaries will have to continue settling the home loan. The need to obtain mortgage protection and the exceptions to this are set-out in Section 126 of the Non-mortgage Consumer Debt Act 1995.

As an example, you can get: Lowering term cover: The quantity that this plan covers reduces as you pay off your home mortgage and the plan ends when the mortgage is settled. Your premium does not transform, also though the level of cover decreases. This is one of the most usual and least expensive form of mortgage defense.

So, if you pass away before your mortgage is settled, the insurer will certainly pay out the original amount you were guaranteed for. This will certainly repay the home mortgage and any kind of staying balance will certainly go to your estate.: You can add severe ailment cover to your home mortgage insurance policy. This indicates your home mortgage will be repaid if you are detected with and recover from a significant health problem that is covered by your plan.

This is much more costly than other kinds of cover. Life insurance coverage cover: You can make use of an existing life insurance coverage policy as home loan defense insurance policy. You can just do this if the life insurance policy policy supplies adequate cover and is not appointed to cover an additional loan or home loan. Mortgage repayment protection insurance is a sort of payment defense insurance coverage.

Home Loan Protection Insurance Calculator

This kind of insurance coverage is normally optional and will normally cover payments for one year - life and critical illness mortgage cover. You ought to consult your home mortgage loan provider, insurance broker or insurance policy firm if you are unsure concerning whether you have home mortgage settlement security insurance. You should additionally inspect specifically what it covers and make certain that it fits your situation

With a home mortgage life insurance policy, your recipient is your home mortgage lending institution. This suggests that the money from the benefit payment goes directly to your home mortgage lending institution.

Loan Protection Insurance Comparison

Obtaining a mortgage is one of the greatest duties that grownups encounter. Falling behind on home loan repayments can lead to paying even more rate of interest costs, late charges, repossession process and even shedding your residence. Mortgage security insurance (MPI) is one means to protect your household and investment in case the unimaginable occurs.

It is particularly helpful to individuals with costly home loans that their dependents could not cover if they died. The vital distinction between home loan defense insurance policy (MPI) and life insurance coverage hinges on their protection and adaptability. MPI is particularly created to pay off your mortgage equilibrium straight to the loan provider if you die, while life insurance gives a wider fatality advantage that your beneficiaries can make use of for any type of economic demands, such as home loan repayments, living costs, and debt.

Latest Posts

Senior Care Usa Final Expense

Life And Burial Insurance

Final Expense Insurance Quote